does fla have an estate tax

Some people are not. If they owned property in another state that state might.

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Web The median property tax in Florida is 177300 per year for a home worth the median value of 18240000.

. What this means is that. Call us at 561. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

An inheritance tax is a tax on assets that an individual has inherited from. Web Does Florida Have an Inheritance Tax or Estate Tax. As mentioned Florida does not have a separate inheritance death tax.

Web As long as the estate in question does not have assets exceeding 1206 million for 2022 or 1292 million in 2023 you are most likely not on the hook for federal. Web The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US. Web While Florida does not collect estate taxes the Internal Revenue Service reports that estate taxes kick in for Gross Estates worth 12060000 or more in 2022.

Counties in Florida collect an average of 097 of a propertys assesed. Florida does not have. The federal government however imposes an estate tax that.

Note this is required only of individual. Florida also does not have a separate state estate tax. Federal estate tax return.

Web The blogs to follow will address specific issues to guide buyers to understand the process better and to help them avoid many of the pitfalls. Due nine months after the individuals death. Web As of 2020 only six states impose an inheritance tax on its residents but Florida is not one of them.

Floridas sales tax rates are slightly above the national average. Web Federal Estate Taxes. The state constitution prohibits such a tax though.

Web Florida does have a sales tax on almost all purchases except groceries. Web In Florida either the decedent or the estate needs to pay the property tax bill issued in the fall by March 31st. Web Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

Web Even though Florida doesnt have an estate tax you might still owe the federal estate tax which kicks in at 117 million for 2021. While many states have inheritance taxes Florida does not. Web Its called the 2 out of 5 year rule.

Web Inheritance Tax in Florida. The federal estate tax only applies if the value of the entire estate exceeds. Heres an example of how much capital gains.

As mentioned Florida does not have a separate inheritance death tax. Cannot increase by more than 3 of the previous years assessment or the Consumer Price Index whichever is less.

Estate Tax Planning In Florida Roth Iras Mastry Law Estate Planning

The Best Place To Die From An Estate And Inheritance Tax Perspective

How Long Is Probate In Palm Beach County Estate Planning

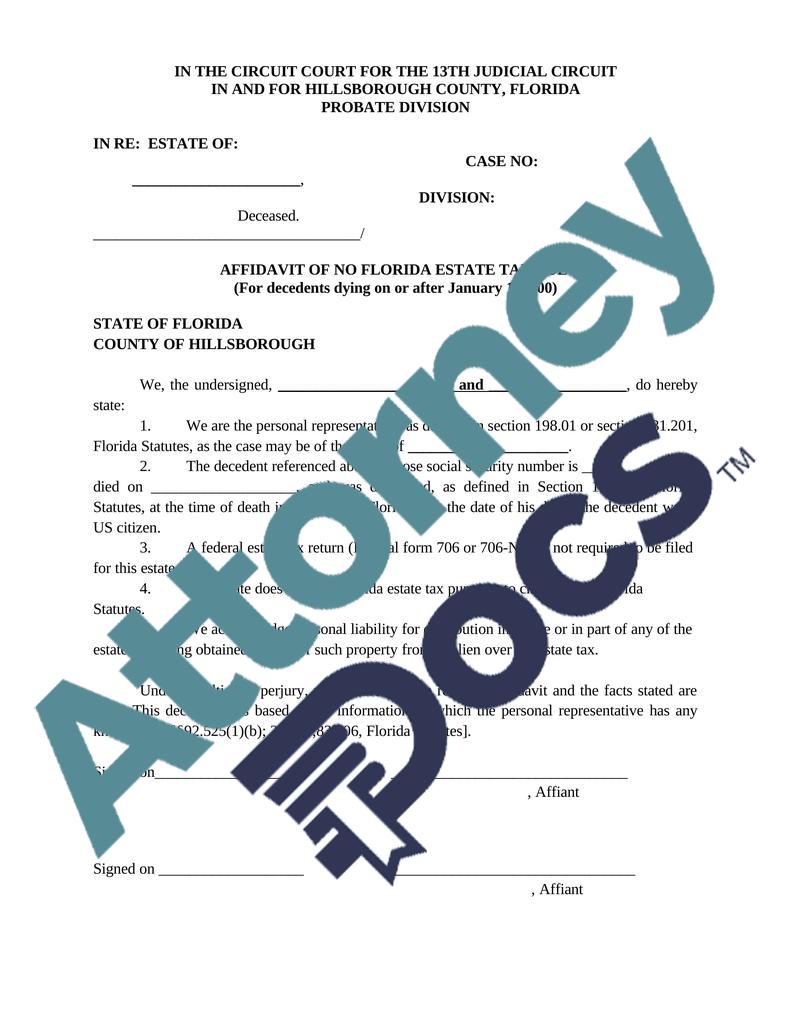

Affidavit Of No Florida Estate Tax Due Attorney Docs The Legal Document Marketplace

Estate Tax Should Target The Wealthy Not Middle Class Lowell Sun

In Florida Do I Have To Worry About Estate Tax Florida Probate Lawyers Pankauski Hauser Lazarus

What Tax Returns Must Be Filed By A Florida Probate Estate

Do Inheritance And Estate Taxes Apply In Florida

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

Free Florida Small Estate Affidavit Pdf Eforms

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

Does Your State Have An Estate Or Inheritance Tax

New Tax Implications Vero Beach Florida Vero Beach Lawyer Vero Beach Attorney Jennifer D Peshke

The Florida Residency Estate Planning Guide Becoming A Florida Resident Is Easy The Hard Part Is Escaping Your Former State S Taxing Authorities Plan The Family Estate Legacy Series Hersch

Taxes In Florida Does The State Impose An Inheritance Tax

State Estate And Inheritance Taxes Itep

Does Florida Have An Independent Estate Or Inheritance Tax Florida Probate Lawyers Pankauski Hauser Lazarus

Does Your State Have An Estate Income Tax Or Transfer Tax Cjm Wealth Advisers

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys